News

The eToro fees: all you need to know!

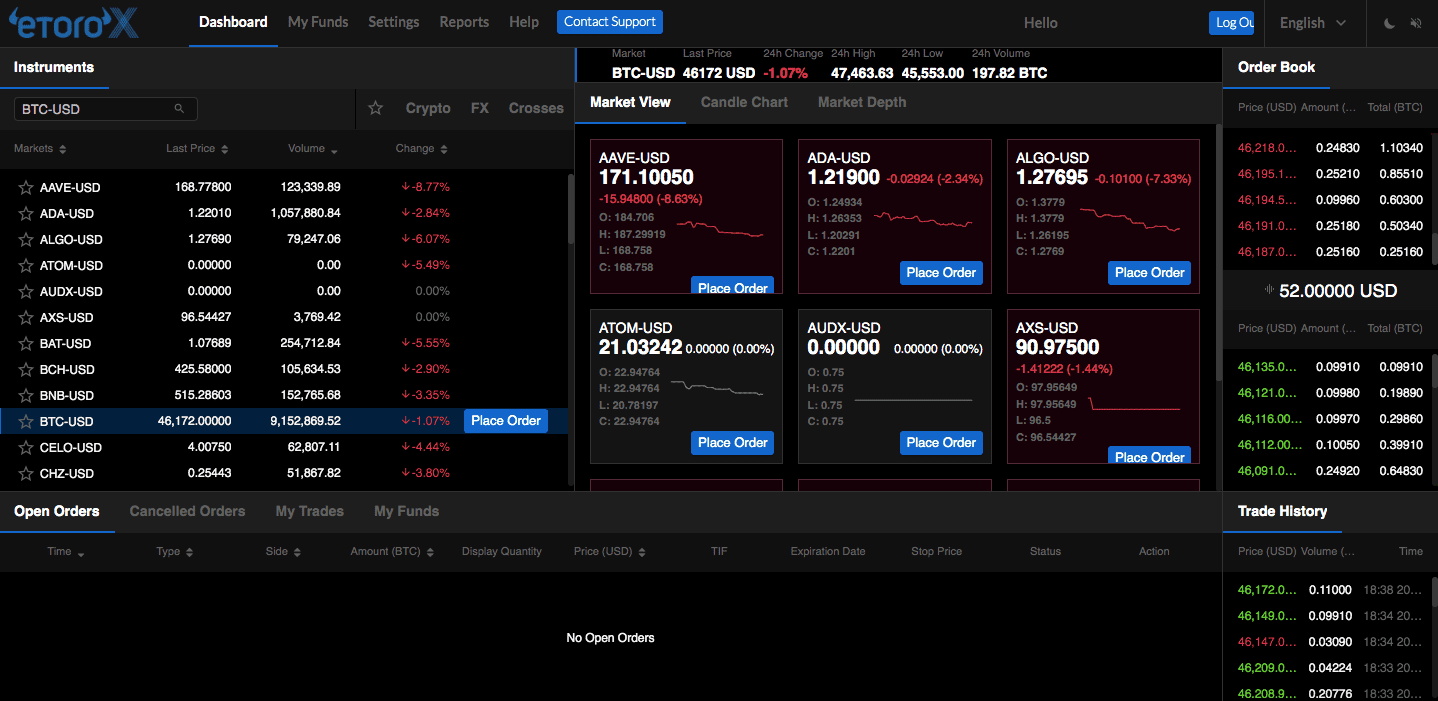

- Fees at eToro have a huge impact on the quality of your trading strategy and the gains you can make. There are many novice traders who do not take this element into account when they decide to speculate in the financial markets. However, eToro fees allow you to know the amount of your transactions, for each position you open.

In order to help you improve your trading strategy on eToro, we have decided to provide you with comprehensive information about its fees. For this, we will answer all the questions you ask yourself: what are the fees and commissions of eToro? On which instruments are eToro fees available?

What are the eToro fees?

The eToro fees are as follows:

Spreads

Child care costs

Inactivity fees

Withdrawal fees

Currency conversation fees

eToro fees and commission: the essentials clearly explained

Fees at eToro depend on the financial asset you wish to trade on. This means that they are not fixed. For example, the eToro price on cryptocurrencies is different from that on commodities. In order to help you better understand the expenses you will incur on the different positions you open, we are going to give you more details on eToro’s fees.🙂

What are the fee categories at eToro?

The eToro fee categories are :

Spreads

Child care costs

Inactivity fees

Withdrawal fees

Currency conversion fees

As we mentioned before, eToro fees depend on the financial instrument you are trading. Most of these fees are taken day-to-day, when you open positions with the broker!

You should also know that eToro’s price is not fixed. It is subject to many variations and these apply only to the opening of positions. That said, it’s important that you know what each eToro fee refers to, so you know how it impacts your transactions.

Spreads

- The spread is one of the eToro fees available from the broker in crypto

. This is his compensation for the positions you open on CFDs. This is the difference or the difference between the buying price (Ask price) and the selling price (Bid price) of a financial asset!

As an example, let’s say you want to trade the EUR/USD currency pair. If the Ask price is 1.5860 and the Bid Price is 1.5854, the difference of 0.0006 (6 pips) represents the spread, which is the broker’s compensation!

Childcare costs

eToro custody fees are also called “rollover costs” or “overnight fees”. They are applied to all positions you open with leverage. At eToro, this happens with CFD trading.

The principle of custody fees is simple. For them to be taken, you must open a position overnight, until the next day at least. Instead of selling or exiting your position on the day of purchase, you trade it for a new day. So, to keep your position open all night, the broker charges a commission or interest, which is the swap, overnight or custody fee!

Withdrawal fees

eToro also charges withdrawal fees. They are applied when you withdraw your earnings from your trading account. So if you are looking for more information visit tradersunion for Interesting articles.

Currency conversion fees

The single currency used on eToro is the US dollar. Thus, when you make a deposit, eToro converts your money into the currency used on its platform and charges you an exchange fee!

You can find more explanations of the fees related to eToro in our special file eToro notice.

News

Ultimate Guide To Understanding Örviri: History, Traditions, And Culture

Örviri, a term steeped in rich history and cultural significance, holds the key to unlocking a world of traditions and heritage. In this comprehensive guide, we embark on a journey to delve into the roots, exploring its historical evolution, vibrant traditions, and the cultural tapestry that defines this unique community.

Ancient Roots and Evolution

Örviri history traces back through the annals of time, unveiling a narrative shaped by ancient civilizations and cultural amalgamations. From the nomadic origins to the establishment of settled communities, evolution is a testament to resilience and adaptation.

Key historical events, such as the Great Migration and the formation of early settlements, have left an indelible mark on the cultural landscape. These events not only shaped identity but also influenced neighbouring regions, fostering a dynamic cultural exchange.

Key Historical Figures

Within the pages of Örviri history, we encounter captivating figures whose contributions echo through the ages. Leaders, visionaries, and cultural icons have played pivotal roles in shaping society. Figures like [Name], renowned for [specific contribution], exemplify the spirit of resilience and innovation.

Rituals and Ceremonies

Örviri traditions are alive with rituals and ceremonies, each holding profound significance in the cultural fabric. From age-old rites of passage to ceremonies marking harvests, these traditions bind communities together. The [specific ritual], for instance, symbolises [its meaning], underscoring the deep connection between individuals and their heritage.

Festivals and Celebrations

Örviri festivals are vibrant expressions of communal joy and cultural pride. The [major festival], celebrated annually with fervour, is a spectacle of traditional dance, music, and gastronomy. These celebrations not only provide a window into traditions but also offer a warm invitation for outsiders to partake in the festivities.

Lifestyle and Daily Routines

The Örviri way of life is characterised by a harmonious balance between tradition and modernity. Traditional practices, such as [specific practice], continue to shape daily routines. Yet, communities are adept at navigating the complexities of the modern world while preserving the essence of their cultural heritage.

Art and Craftsmanship

Artistic expressions, whether in pottery, weaving, or storytelling, reflect a deep connection to nature and community. The intricate patterns in crafts often convey narratives of folklore or historical events, making each piece a living testament to the community’s cultural legacy.

Örviri Social Structure

Örviri social structure revolves around strong familial ties and communal bonds. Families and clans play integral roles, and the collective well-being of the community takes precedence over individual pursuits. Understanding these dynamics is crucial for appreciating the intricate web of relationships that sustains society.

ommunication and Language

Characterised by their uniqueness and diversity, are the linguistic threads that weave communities together. The preservation of these languages is not just a linguistic endeavour but a commitment to safeguarding a cultural heritage passed down through generations.

Örviri in the Modern World

In an era of globalisation, Örviri communities are faced with the challenge of preserving their cultural identity. Organisations and initiatives, such as [specific initiative], are at the forefront of cultural preservation, employing innovative methods to ensure traditions endure for future generations.

Contemporary Issues

Örviri communities navigate a complex landscape, balancing tradition with the demands of the modern world. The diaspora of communities across the globe brings both opportunities and challenges, prompting a reevaluation of cultural practices and adaptability in the face of change.

Travelling to Örviri Regions

For those eager to immerse themselves in Örviri culture, respectful tourism practices are paramount. Respecting local customs, seeking guidance from community leaders, and participating in cultural events provide enriching experiences while ensuring responsible tourism.

Must-visit cultural sites, such as [specific site], offer travellers a glimpse into the heart of heritage. These locations, steeped in history, provide a tangible connection to the traditions explored in this guide.

Frequently Asked Questions about Örviri

Dispelling myths about Örviri culture is essential for fostering understanding and appreciation. Contrary to [myth], culture is [fact]. Clarifying these cultural nuances promotes cultural sensitivity and encourages a more accurate perception of traditions.

Resources for Further Learning

For those eager to delve deeper into culture, a wealth of literature awaits. [Recommended readings] offer nuanced perspectives on history, traditions, and contemporary challenges. Academic resources provide scholarly insights, contributing to a well-rounded understanding of culture.

Cultural Experiences

Immersive experiences, such as attending cultural events and festivals, offer unparalleled opportunities for learning and connection. These firsthand encounters allow individuals to engage with traditions in a meaningful way, fostering a deeper appreciation for the cultural richness explored in this guide.

Conclusion

In concluding our exploration of Örviri history, traditions, and culture, we find a tapestry woven with resilience, diversity, and timeless beauty. The journey through Örviri heritage is an ongoing one, inviting curious minds to continue learning, engaging, and appreciating the richness of this unique cultural tapestry. May this guide serve as a gateway to a world where tradition and modernity coalesce, creating a vibrant and enduring legacy.

News

Cameron Herren: Pioneering Innovation and Leadership

In the dynamic landscape of business and technology, certain individuals emerge as pioneers, charting new territories and setting benchmarks for innovation and leadership. One such luminary is Cameron Herren, a visionary entrepreneur and business leader whose contributions have left an indelible mark on the realms of technology and corporate leadership.

Early Life and Education

Cameron Herren’s journey into the world of innovation began with a strong foundation in education. Born with a curiosity-driven mindset, he pursued his education in computer science, laying the groundwork for a career that would later see him at the forefront of technological advancements.

Entrepreneurial Spirit

Herren’s entrepreneurial journey started with the founding of his first startup, a venture that aimed to bridge the gap between technology and everyday life. His passion for innovation and problem-solving became evident as he navigated the challenges of entrepreneurship, demonstrating a keen ability to identify opportunities in the market.

Tech Visionary

Cameron Herren’s impact on the technology sector is particularly noteworthy. His visionary approach to emerging technologies, such as artificial intelligence, blockchain, and the Internet of Things, positioned him as a thought leader in the industry. Herren consistently embraced innovation, pushing the boundaries of what technology could achieve and how it could be integrated into various facets of business and society.

Leadership Style

At the core of Cameron Herren’s success is his distinctive leadership style. Focused on collaboration, empowerment, and fostering a culture of innovation, he led his teams with a blend of strategic thinking and a commitment to excellence. Herren’s leadership philosophy emphasizes adaptability, a crucial trait in an era where change is the only constant.

Corporate Successes

Herren’s career is punctuated with numerous corporate successes. Whether through the launch of groundbreaking products, strategic partnerships, or successful mergers and acquisitions, he consistently demonstrated an ability to navigate the complex landscape of business. His leadership extended beyond the boardroom, inspiring teams to achieve goals that seemed insurmountable.

Philanthropy and Social Impact

Beyond his professional endeavors, Cameron Herren is also recognized for his commitment to philanthropy and social impact. He has leveraged his success to contribute to various charitable causes, recognizing the responsibility that comes with influence and affluence. Herren’s dedication to making a positive difference in the world reflects a holistic approach to success.

Legacy and Future Endeavors

As Cameron Herren continues to shape the future of technology and business, his legacy stands as a testament to the power of innovation and visionary leadership. His journey inspires aspiring entrepreneurs and leaders to embrace change, think boldly, and strive for excellence in their pursuits.

Conclusion

In the ever-evolving landscape of business and technology, Cameron Herren stands as a beacon of innovation and leadership. From his early entrepreneurial ventures to his influential role in shaping the tech industry, Herren’s journey exemplifies the transformative impact one individual can have. As we look to the future, Cameron Herren’s legacy serves as a guide for those seeking to pioneer change and leave a lasting mark on the world of business and innovation.

News

Maria Gjieli: A Rising Star in the World of Music

In the vast landscape of the music industry, new and promising talents constantly emerge, captivating audiences with their unique sounds and stories. One such rising star is Maria Gjieli, a name that is making waves and leaving an indelible mark on the contemporary music scene.

Early Life and Background

Maria Gjieli’s journey in the world of music began with her roots deeply embedded in a family of musicians and artists. Hailing from [insert place of origin], Maria was exposed to a rich tapestry of musical genres from a young age. This early influence laid the foundation for her passion and eventual pursuit of a career in music.

Artistic Style and Influences

Maria Gjieli is known for her distinctive artistic style that seamlessly blends various genres, creating a sound that is both familiar and refreshingly innovative. Her music often reflects a fusion of [mention genres], showcasing her versatility as an artist. Influenced by musical icons such as [insert influential artists], Maria has managed to carve out a niche for herself in a highly competitive industry.

Breakthrough Moments

Every artist has defining moments that mark their ascent to stardom. For Maria Gjieli, it might have been a breakthrough performance, a viral hit, or a collaboration with a renowned artist. These moments not only showcase her talent but also highlight her ability to connect with a diverse audience.

Notable Achievements

Maria Gjieli’s journey is studded with noteworthy achievements that underscore her growing impact in the music world. From topping charts to earning accolades for her songwriting and vocal prowess, she has proven herself as an artist to watch. Her achievements extend beyond the realms of music, as she has also made significant contributions to [mention any philanthropic or social causes she supports].

The Evolution of Maria Gjieli

As an artist evolves, so does their music. Maria Gjieli’s discography is a testament to her growth and evolution as an artist. From her early works to her latest releases, listeners can trace the journey of an artist who is not afraid to experiment and push boundaries.

Fan Base and Global Appeal

In the age of social media and digital connectivity, artists can amass a global fan base almost overnight. Maria Gjieli is no exception, with fans spanning across continents. Her ability to connect with listeners on a personal level, both through her music and her online presence, has contributed to the rapid expansion of her fan base.

Future Prospects and Projects

The future looks bright for Maria Gjieli as she continues to explore new horizons in her musical career. Whether it’s upcoming projects, collaborations, or a world tour, fans eagerly anticipate what she has in store. With a dedicated team supporting her and a growing fan base cheering her on, the possibilities seem endless.

Conclusion

Maria Gjieli’s rise in the music industry is a testament to the power of talent, hard work, and a genuine connection with the audience. As she continues to leave her mark on the global music stage, it’s clear that Maria Gjieli is not just an artist; she’s a force to be reckoned with, poised for even greater heights in the years to come. Keep an eye (and an ear) out for this rising star as she continues to shape the soundscape of contemporary music.

-

News2 years ago

News2 years agoDr. Naval Parikh: Hypertension Types, Causes, Symptoms & Treatment

-

News2 years ago

News2 years agoDr. Naval Parikh: Allergy Types, Causes, Symptoms & Treatment

-

News2 years ago

News2 years agoDr. Naval Parikh: Asthma Causes, Symptoms and Treatment Options

-

Celebrity4 years ago

Celebrity4 years agoYoung Irish Star Signs to DJ John Gibbons’ label

-

News3 years ago

News3 years ago8 Best Sites Like VIPLeague to Watch Free Sports in 2021

-

News1 year ago

News1 year agoTinyZone: WatchFree Movies Online

-

News2 years ago

News2 years agoTampa Van Hire

-

Uncategorized2 years ago

Uncategorized2 years agoInstagram’s Most Popular Product Niche